In philanthropy, we have been talking a lot about the crucial need for funders to provide more multiyear, general operating support. That’s important, and I also think we need to talk more about the size of grants. Why? At least from what I can see in CEP’s Grantee Perception Report (GPR) data, even though the size of many funders’ grants has grown in real terms over time, a meaningful proportion haven’t kept pace with inflation.

Following the pandemic, rates of inflation were higher than they’d been in a generation, topping out at around eight percent in 2022. Costs rose across sectors, and nonprofits weren’t immune to those effects. CEP’s Nonprofit Voice Panel illuminates that even though many foundation-funded nonprofits maintained balanced budgets in 2022, those that weren’t able to do so pointed to reasons of higher than expected costs and lower than anticipated individual giving (which is also very possibly linked to higher inflation).

But let me start with the good news in our data. Of 72 funders that recently used the GPR and had used it at least once ten or more years earlier, more than half increased the size of their typical grant in real terms between their first and most recent GPR. The median real increase was $8,000 — representing an increase of eight percent. That’s great to see, and it parallels some evidence showing other ways that grantmakers are thinking carefully about how best to sustain crucial nonprofit efforts: Since the pandemic, grantees report increased trust, streamlined processes, and slightly increased provision of unrestricted support.

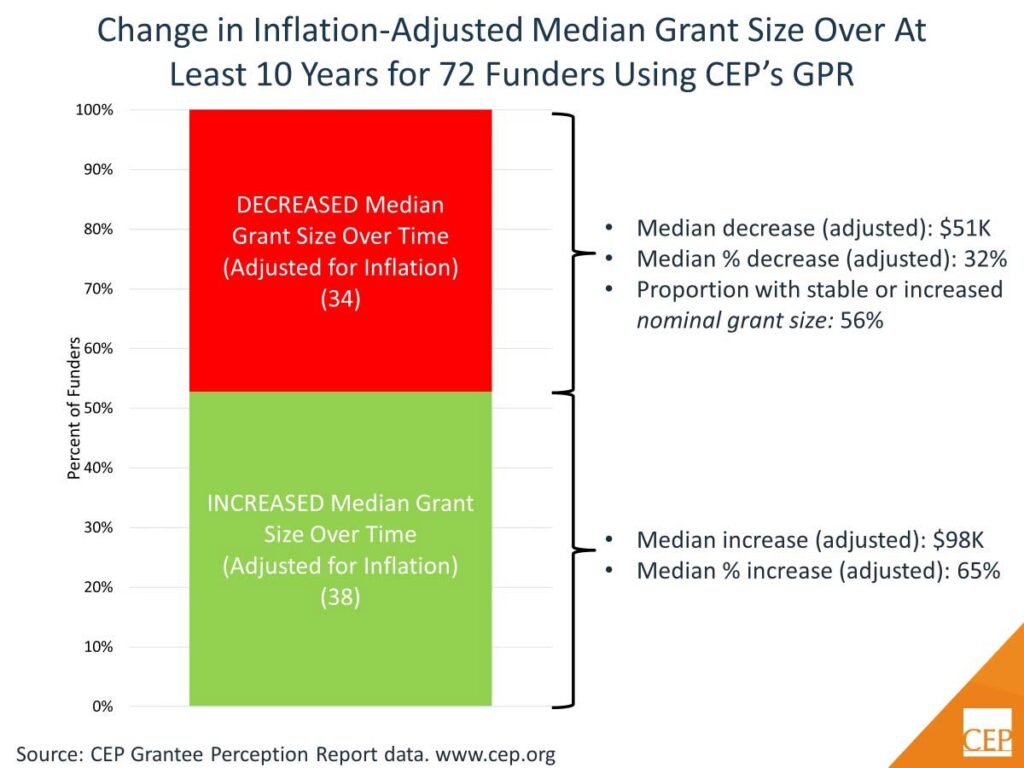

The story is a little more complicated, though. While a little more than half of the 72 funders examined in this analysis had inflation-adjusted increases in their grant size, just under half had inflation-adjusted decreases in grant sizes. Looking at just the 38 funders with increased real grant size, the typical real increase was actually close to $100K and a median increase of 65 percent. To me that suggests a conscious decision by those funders to increase grant sizes.

On the other hand, among the 34 funders whose grant sizes decreased in real terms, the median size of that decrease was about $50K in real terms, representing shrinkage of about 32 percent. The thing is, some of this is likely invisible. Rather than a choice to decrease grant sizes, some of these funders may simply have let inflation whittle away their value. Why do I think this? More than half of these funders either had stable or even increased grant sizes in nominal terms, suggesting that for at least some of them, they simply weren’t keeping up with inflation.

Of course, some funders may have made conscious decisions to decrease their grant sizes. When I’ve raised these findings with funders, I sometimes hear that decreased grant sizes are a conscious choice funders made as they reoriented their efforts to focus on smaller, sometimes grassroots grantees. It’s an equity decision, they say. I’m sure that’s true in some cases, but I’d push back on that perspective in a couple ways.

First of all, at least for these 72 funders, that doesn’t seem to play out in the numbers. Inflation-adjusted grantee budget size has actually increased at the majority of these funders. And only one in five funders that gave out smaller grants than they used to (in real terms) are also supporting grantees whose budgets were smaller by a proportionally larger amount. In other words, if the argument funders are making is that they’re giving smaller grants to smaller organizations, that’s only rarely the case. And, if grantees actually have bigger budgets than they used to, well, that’s another argument for increasing grant sizes.

Second, and more fundamentally, I’d challenge the notion that working with grantees with smaller budgets requires funders to give smaller grants! The notion of how much money a grantee can absorb is a real consideration, but the typical grant in our GPR dataset only funds about four percent of a grantee’s annual organizational budget. I think all nonprofits can “absorb” a little more than that. This is a place where early insight from MacKenzie Scott’s grantmaking might be instructive. At least in their first few years after receiving grants, recipients, who often receive grants that are fully 80 percent of their annual budgets or more, are not indicating unexpected challenges in putting that money to work.

Monitoring stats like inflation-adjusted grant size should be easy for any funder. I’d argue every leadership team dashboard should have that stat included, and every program officer should regularly review real grant size over time for their grantees. Grants management systems should make this simple.

In recent years, nonprofit organizations have faced a multitude of challenges, from the lingering effects of the pandemic to concerns with burnout and staff wellbeing to ongoing economic uncertainty.

Please, funders, don’t let silently shrinking grants add to nonprofits’ list of worries.

Thank you to Emma Relle, a senior analyst on CEP’s Assessment and Advisory Services team, who contributed to this post and helped to ensure this data was correct.

A note on methods: I used data from 72 funders for this analysis. These funders are not representative of all funders, but they include a lot of names you’d recognize. First, I identified all funders whose most recent GPR was conducted in 2020 or later because I wanted to account for recent years of inflation. From among those, I identified funders whose first GPR was at least 10 years prior to their most recent because I wanted the confidence of a long period of time and not just a recent fluctuation. From there, I used a simple CPI calculator to adjust all grant and grantee budget sizes into 2024 dollars. For example, a funder that had a median grant of $100K in 2003 would need to be making a median grant of roughly $165K in 2023 to have kept pace with inflation.

Kevin Bolduc is vice president, Assessment and Advisory Services, at CEP. Find him on LinkedIn.